- EGR MON

- NFE

- NFSE

- CTE

- MAN

Monitor

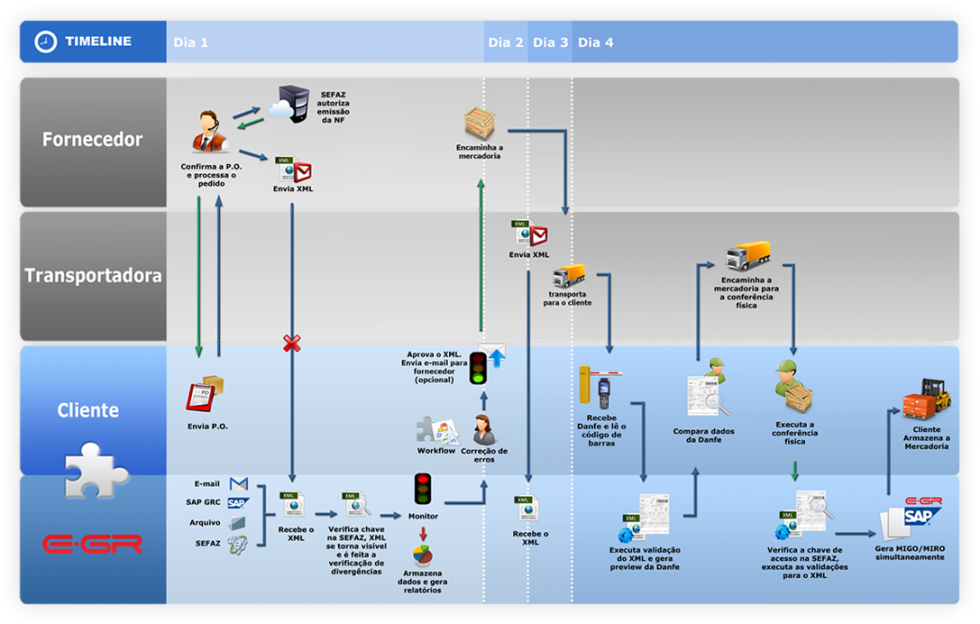

E-GR MON – With E-GR Monitor it is possible to group service invoices based on the Supplier/CNPJ code to control the documents issued and display validations aimed at systemically implementing the fiscal intelligence acquired by users. Another important feature is the linking of subsequent events to the original XML, for example: (Correction Letter, CTe, passage through a tax office, admission to Suframa, etc).

Note: The E-GR MON Module is structural and its acquisition is mandatory for licensing the other modules.

Market entry automation

E-GR NFE – Automation of the physical and/or fiscal receipt of documents. This module allows you to:

- MIGO / MIRO

- Only MIGO 1

- Only MIRO 2

- NF Writer 3

- Sales returns

- Dynamic process

These processing modes are determined according to the nature of the operation represented by the CFOP contained in the XML.

- Scenarios where physical receipt and tax receipt occur at different times and require two independent entries with tax bookkeeping (e.g., consignment entry, invoicing with future delivery, symbolic return, etc;)

- Scenarios where there is only the tax posting (MIRO), without the goods being received (e.g., consignment, billing with future delivery, expense posted as an additional cost, etc.);

- Scenarios where there is only tax bookkeeping via NF Writer (e.g., Other entries, return of lending, etc.).

Market entry automation

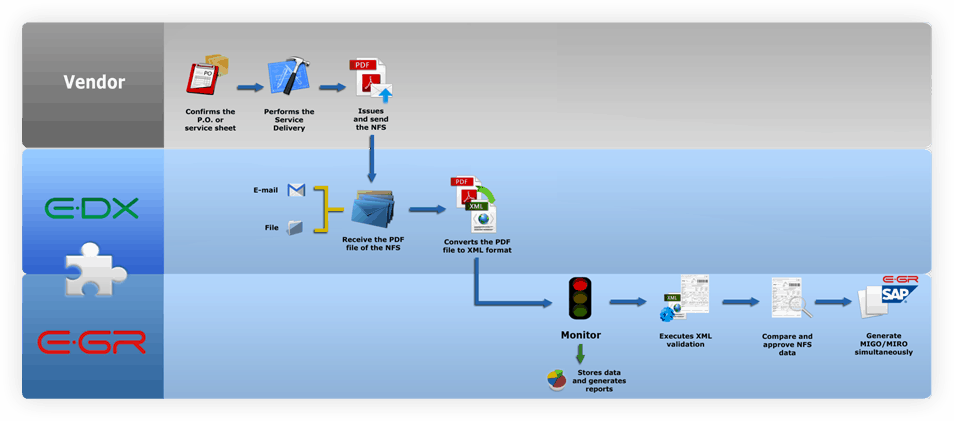

Invoice entry automation

E-GE NFSe – This module contains the converter of the Service Invoice bookkeeping process, allowing not only the accounting entry, but also its respective tax bookkeeping in the J_1B* tables using MIRO’s BAPI to create a document that unifies: Accounts Payable, Expense/Cost Posting, Accounting, Tax Withholding and Tax Bookkeeping.

Once the NFSe has been captured, its data is structured in an XML file that will be broken down using a layout previously customized by the user, converting this data to the ABRASF (Brazilian Association of Capital Finance Secretariats) layout.

Service invoice entry automation

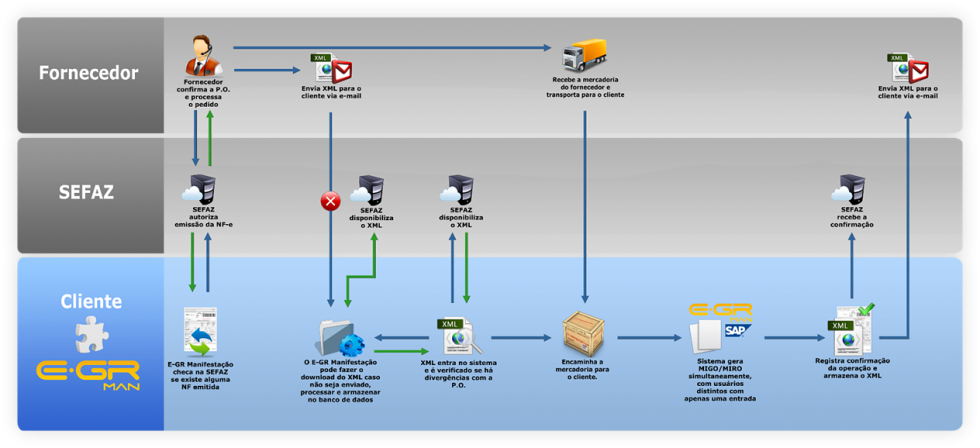

Knowledge entry automation

E-GR CTe – Automation of electronic bill of lading tax writing in bulk, taking credit based on the nature of the operation and the NFe being transported. In addition, the system checks whether the NFe being transported in the CTe exists in the SAP database (as outgoing or incoming), validating the access key and creating a direct link to the NF. So that the user can access the documents via a simple drill-down.

MAN – Manifestation of the recipient

E-GR MAN – Allows the company to carry out the Recipient Manifestation directly through the Monitor (within SAP ECC) or automatically, at the time the tax return is made.

MAN – Manifestation of the recipient

Automation of NF-E entries

And SAP electronic processing.

E-GR allows your company to act proactively on problems, detecting them on receipt of the SML or in your ERP system before the goods are sent by your supplier. E-GR improves with each process with reports that identify the frequency and origin of problems.

The system has been designed using an innovative cockpit concept, which allows for more intuitive, user-friendly use and processing, with maximum automation in goods receiving. Fully developed using the best SAP technology, it offers a holistic view of programming, resulting in a stable and flexible system.

The advanced modeling method, as well as a thorough study of the objects native to SAP’s R/3 and ECC systems, together with the best market practices, resulted in a robust, stable and yet simple system that avoids failures in understanding and controlling process flow.

Implementing the E-GR system improves and streamlines processes in the areas of supply chain, physical reception, warehousing, production planning, tax and finance. If your company has several production / distribution sites, there will be uniformity in the processes and a much more comprehensive and accurate management view of all the NF-Es.

Tax checks and administrative rules are completely automated by the system and any deviations detected are resolved before the goods leave the supplier, thus avoiding them. Delays in receipt and inconvenience related to incoming goods with tax problems that take months to resolve.

As the majority of NF-Es, around 80%, do not deviate in any way from the standard accepted by the government or the company itself, the system practically manages this process on its own, giving the company a level of compliance, management and cost reduction never achieved before.

More than automation, it’s a revolution!

E-GR features and differentials

Prevents tax errors by avoiding the entry of NF-e with discrepancies

Anticipates problems by monitoring XML files as soon as they are received

Physical and fiscal receipt made simple with just one click

Intelligent system that improves each process and generates reports

Find out more, get in touch and schedule a presentation